id.extractor

Identity theft and online fraud are issues many organizations must combat. From financial institutions to gaming and telecommunications, the challenge of today’s organizations is to create a seamless ID verification process while reducing transaction friction and deterring fraud.

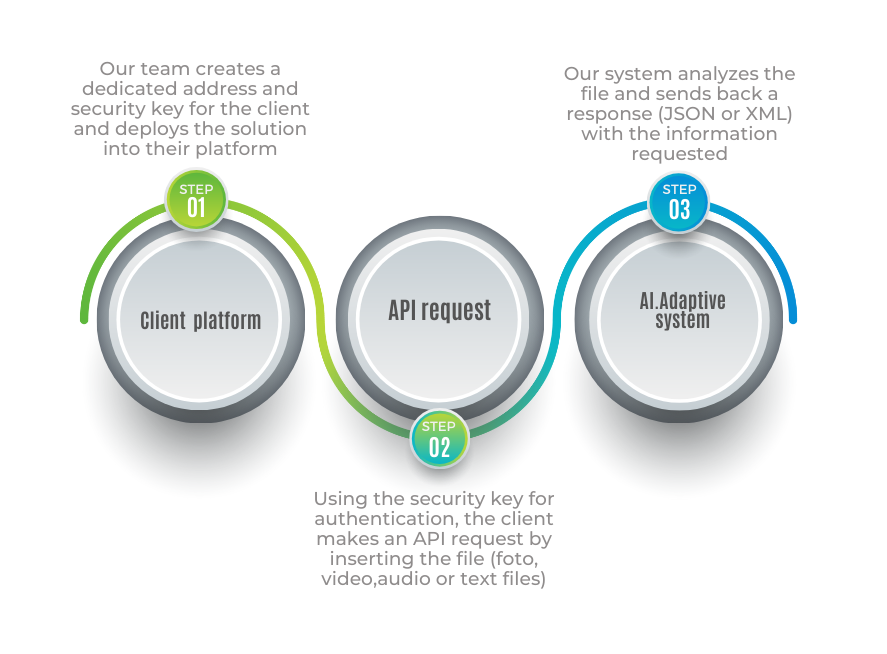

Extract and verify data from the IDs of your customers — anytime, anywhere — with the device that’s always with them — their smartphones. After your users take a picture of their ID, the rest of the work is made by our system using state-of-the-art AI technology and machine learning.